Individual Retirement Accounts Personalized for You

Retirement investing made simple. Setup your account in just a few minutes and let Crecer's automated system invest your retirement savings with a strategy personalized to your investment profile

Get Started

Investing for retirement doesn't have to be time consuming and stressful

Use Crecer's automated investment platform to invest toward a future where you can potentially work less and have more free time

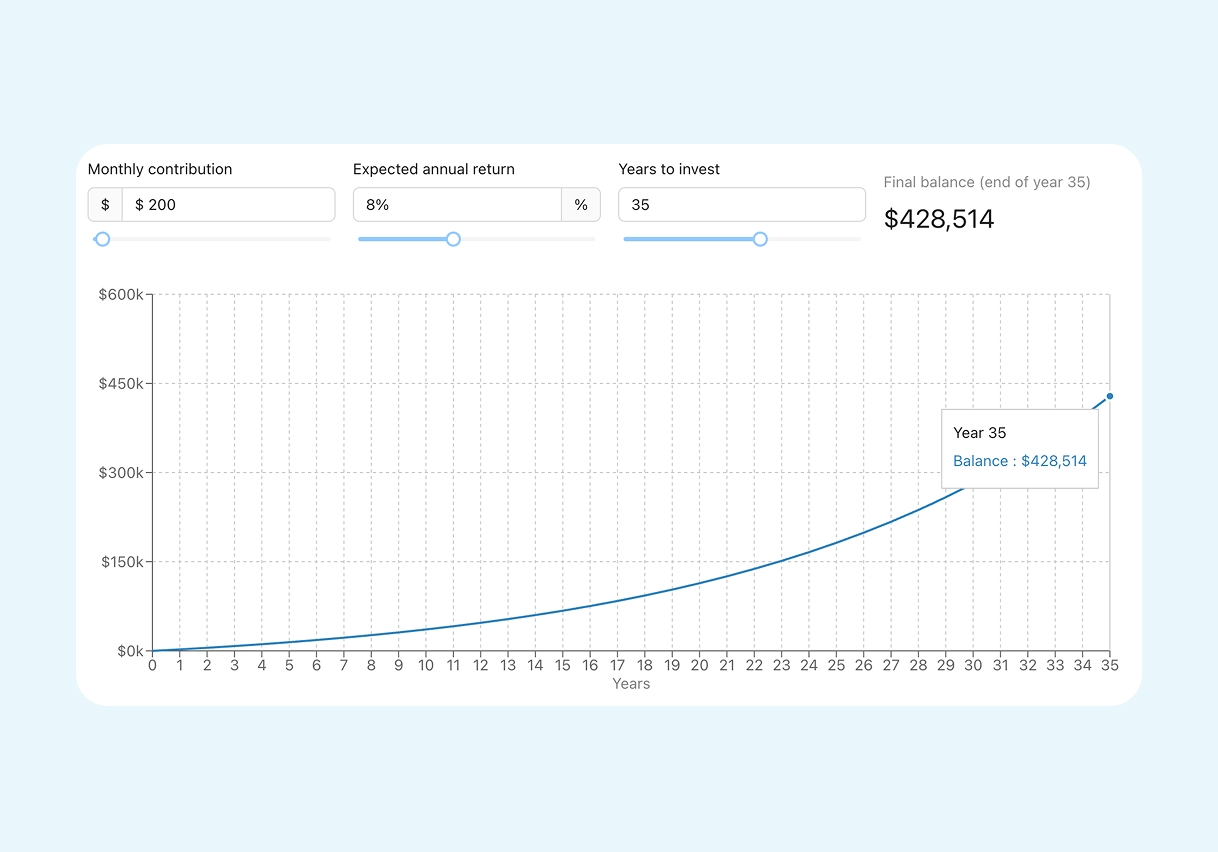

Long term investing can help grow your retirement savings through compounding over time

Consistently investing in your retirement account for multiple years can potentially result in greater retirement savings in the future

The figures shown are for illustrative purposes only and do not represent actual client results. It does not account for market volatility, fees, taxes, or investor behavior, all of which can impact outcomes. Investing involves risk, including the loss of principal.

Personalized investment portfolios automatically managed for you

Your account will be invested in a combination of stocks and bonds that aligns with your profile, carefully selected by our experienced investment team

Account Protection

Our customers' investment accounts held with our custody partner are protected by the Securities Investor Protection Corporation (SIPC) up to $500,000 per customer, which includes a $250,000 limit for cash. SIPC does not protect against losses caused by fluctuations in the market, but it does protect your assets in the event the brokerage firm that holds your account fails.¹

Get Started

Our Investment Strategy for Your Retirement Account

Crecer Individual Retirement Accounts (IRAs)

IRAs are “tax-advantaged” accounts, which means there are tax savings for investing in these types of accounts.

Crecer offers both Traditional and Roth IRAs. The video and table below include some of the key differences between the two types of accounts.

| Traditional IRA | Roth IRA | |

|---|---|---|

| Are contributions tax deductible? | Yes – if you meet the income eligibility requirements. Review the requirements | No |

| Does this account qualify for the IRS Saver’s Credit? Review the requirements | Yes | Yes |

| Are there penalties and taxes on withdrawals before age 59½? | Yes – Unless you meet one of the hardship exemptions you will pay a 10% penalty and taxes on any investment gains. See a list of the hardship exemptions |

|

| Are there taxes on withdrawals after age 59½? | Yes – taxes on all withdrawals. Any after-tax contributions you made, meaning contributions you made in a given year that weren't eligible for a tax deduction, will not be taxed upon withdrawal. | No – as long as the account has been open at least 5 years |

| What are the contribution limits? |

|

|

Get Started