The Risk of Relying on Social Security Income for Retirement

If you’ve ever taken a close look at your paystub, you’ve most likely noticed that you pay Social Security taxes. In fact, 6.2% of your income is paid toward Social Security taxes, and if you’re self-employed you likely pay an additional 6.2%, which amounts to 12.4% of your income. These taxes are used to fund the Social Security program, which provides income to retired workers. Of course, once you retire, you may qualify to receive Social Security income, so a portion of the Social Security taxes you pay will eventually be returned to you. However, relying on Social Security as your only source of income during retirement might not be sufficient.

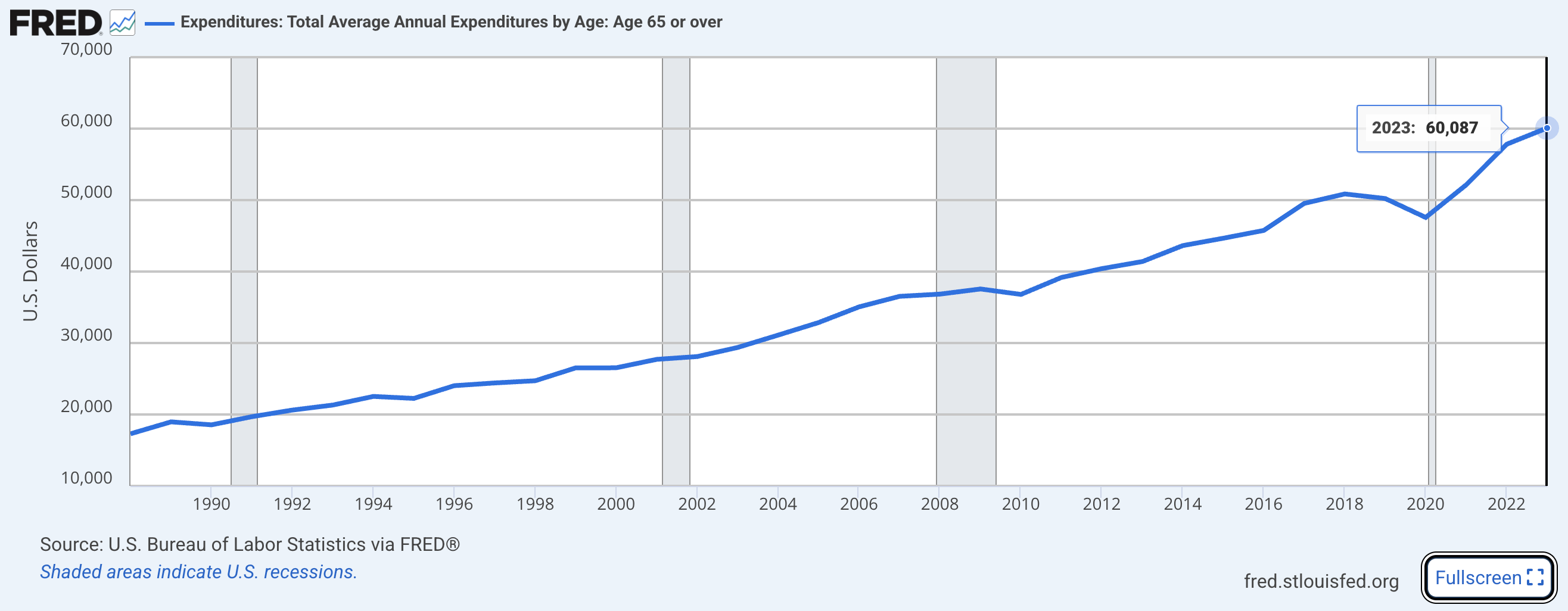

According to the U.S. Bureau of Labor Statistics (BLS), the average yearly spending in the U.S. for people aged 65 and older reached approximately $60,000 in 2023¹, which breaks down to $5,000 per month. It should be noted that there are many factors in this calculation, which includes people who may live in high-cost areas and have enough savings or income to spend more. But there’s no denying that the cost of living has gone up significantly over the past few years, especially when you consider rising healthcare costs.

On the other hand, the average Social Security payment in 2026 is $2,071². The monthly Medicare Part B premium³ of $203 is automatically deducted from the Social Security payment, which reduces the average payment to $1,868 per month. Of course, there are many people who receive a payment below the average - for example, those who worked less than 35 years in the U.S. or didn’t earn a high salary. This is evident when you look at the data for certain demographic groups: in 2024, the average Social Security payment for Hispanic/Latinos was $1,153⁴ (after the Medicare deduction), about 27% lower than the average payment. The unfortunate reality is that even a payment of $1,868 per month is not sufficient for most people to cover all of their living expenses.

Adding to this challenge, the Social Security Administration has publicly stated that by 2033 the program will not have sufficient funds to cover all payments and will only be able to pay up to 77% of the promised benefits⁵. This means that the monthly Social Security payment may be even lower than it is today after you adjust for inflation. 2033 is still seven years away, and the government may solve this problem before then, but it does increase the risk for those who are planning to rely solely on Social Security income during their elderly years when they expect to work less or not work at all.

One way to potentially reduce your dependence on Social Security income is to invest in a retirement account. Investing in your retirement savings can help you prepare for your elderly years when you may not be able to work as much.

Although we're big fans of AI, we want you to know that we write all of our blog posts ourselves and only use AI for research and editing.

Back to Blog

Sources: ¹St. Louis Fed / Federal Reserve Bank of St. Louis. Expenditures: Total Average Annual Expenditures by Age: from Age 65 and older (Series ID: CXUTOTALEXPLB0407M); retrieved from FRED / St. Louis Fed. https://fred.stlouisfed.org/series/CXUTOTALEXPLB0407M ²Social Security Administration. 2026 COLA Update. https://www.ssa.gov/news/en/cola/factsheets/2026.html ³Centers for Medicare & Medicaid Services (CMS). 2025 Medicare Part B Premiums and Deductibles. https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles ⁴Social Security Administration. 2024 Projections by Demographic Group https://www.ssa.gov/policy/docs/projections/tables/beneficiaries.html ⁵Social Security Administration. 2024 Trustees Report: Projected Trust Fund Depletion and Benefit Payouts. https://www.ssa.gov/oact/tr/2024/index.html