Cash vs Inflation

Almost everybody loves cash. Whether it’s in your bank account or hidden under your mattress, it can give you a feeling of comfort knowing you have some cash on hand. What a lot of people don’t realize about cash is that it’s losing value every day because of inflation.

Of course we need cash to buy the things we need (and want) and to pay bills. But if you’re fortunate enough to have a little extra cash leftover after all your expenses have been covered, you may want to think about the value of your cash vs inflation. Unfortunately, we’ve all experienced inflation, especially over the past few years - almost everything has gotten more expensive. Let’s look at a simple example to explain what we mean when we say cash vs inflation.

Let’s say you have $1,000 in cash that you decide to save and put away. Maybe today that $1,000 is enough to buy a new washer and dryer. One way to say this is that the purchasing power of $1,000 is the ability to buy a new washer and dryer.

Now let’s say in 2 years you decide to pull out that saved cash to actually buy a new washer and dryer. Depending on the inflation rate, the same exact washer and dryer you looked at last year may now cost 5% more, or $1,050. Imagine how much more expensive it might be in 10 years. The point is that the $1,000 you saved doesn’t have the same purchasing power anymore, in other words it’s less valuable because of inflation.

One way people try to protect their cash from losing its value is by investing it. There’s no guarantee how investments will perform in the future, but historically over long periods investments such as US stocks and bonds (when taken collectively as a whole, we’re not referring to an individual stock or bond) have often outpaced inflation (this is only true when viewed over long periods of time such as 20+ years). We can illustrate this with an example.

According to S&P Dow Jones Indices (which is a commonly used measure of the total US stock market), the S&P 500 Total Return Index has produced an estimated long-term return of about 10% per year since 1957 (including reinvested dividends)¹. While inflation in the US has averaged about 3-4% a year, based on the Consumer Price Index (CPI-U) published by the Bureau of Labor Statistics.²

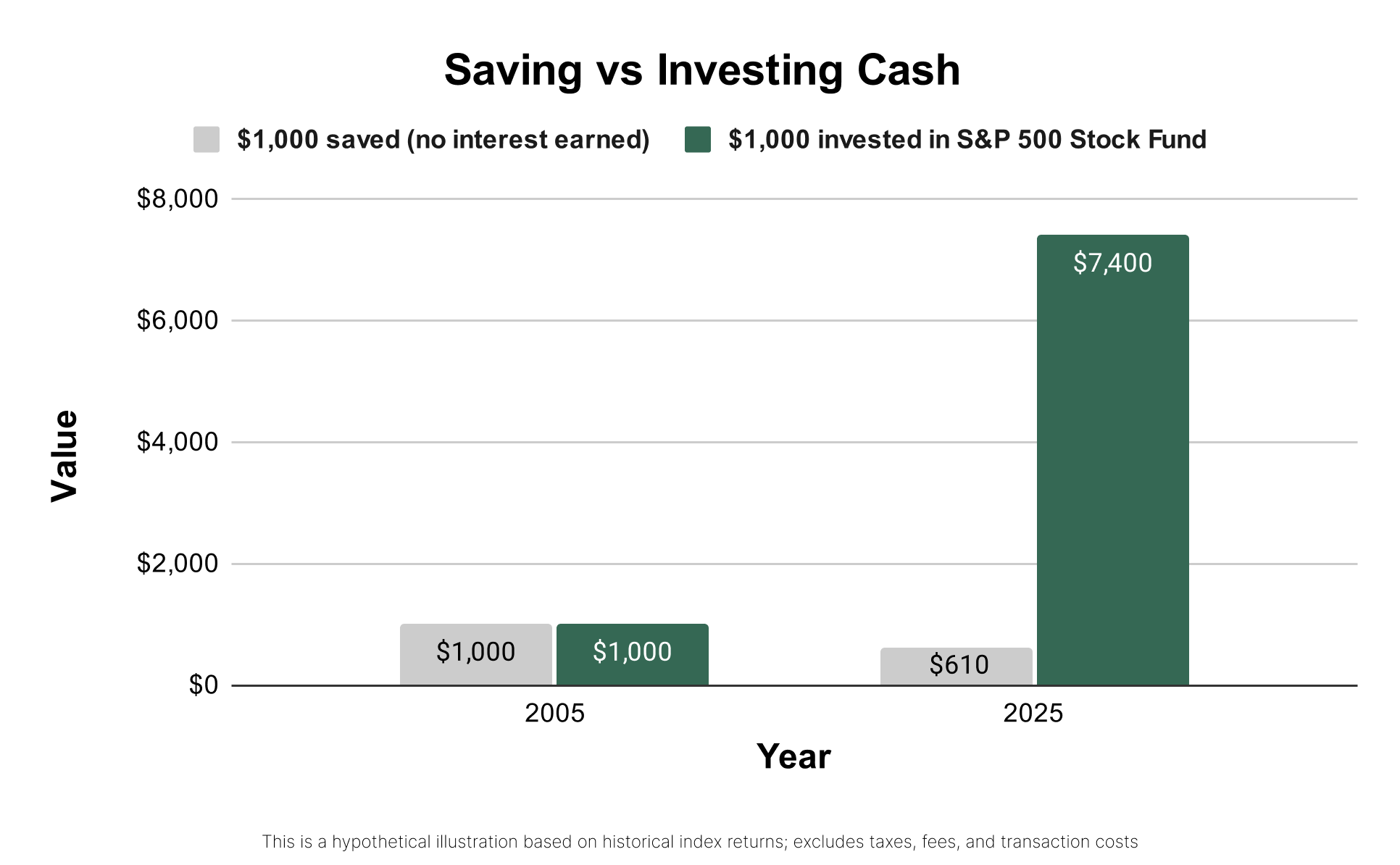

To put this in everyday terms, consider the past 20 years. $1,000 saved in cash in 2005 would have the purchasing power of only about $610 today. Over the same time period, $1,000 invested in the S&P 500 Total Return Index would be worth approximately $7,400 today (before taxes, advisory fees, or transaction costs; past performance is no guarantee of future results).³

Again, there’s no guarantee that the performance from the past 20 years will be similar over the next 20 years - it’s possible stocks will decline and we could even experience deflation. But if the US economy continues to experience inflation and the overall US stock market provides a positive return in the years to come, investing your cash could potentially help preserve its purchasing power after inflation.

Although we're big fans of AI, we want you to know that we write all of our blog posts ourselves and only use AI for research and editing.

Back to Blog

¹Source: S&P Dow Jones Indices, S&P 500 Total Return Index data ²Source: U.S. Bureau of Labor Statistics, Consumer Price Index (CPI-U) ³This is a hypothetical illustration based on historical index returns; excludes taxes, fees, and transaction costs