Whether you’re planning for your own future or you’re a business owner helping employees, Crecer simplifies investing for retirement

Get StartedLearn More

You shouldn't have to work your entire life.

You can still plan for retirement even if your employer doesn't offer a retirement plan that fits your needs.

Individual retirement accounts personalized for you

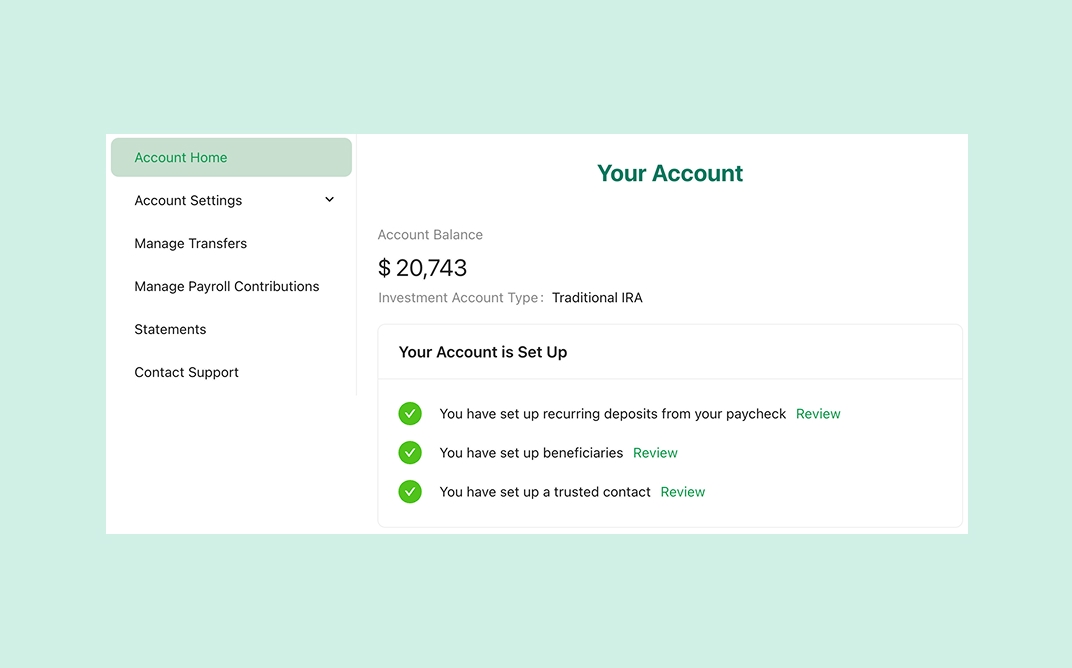

Retirement accounts designed to align with your financial profile

Leverage Crecer's automated system to invest your money so you don’t have to manage the investment decisions yourself

Investing for the long term could help you build up your savings for retirement

An easy way to offer retirement accounts to your employees

Invite your employees to create a Crecer account and help them start saving for retirement

Setup a direct deposit in your payroll system so your employees can contribute to their retirement account directly from their paycheck

There is no cost to the business owner - and with IRAs you're not required to contribute to the employee's account

Help your clients setup their retirement accounts

Bring more value to your clients by educating them on retirement planning

You can faciliate retirement accounts for your individual or business clients within one platform

It takes less than 5 minutes to onboard new clients

Benefits of a Crecer Retirement Account

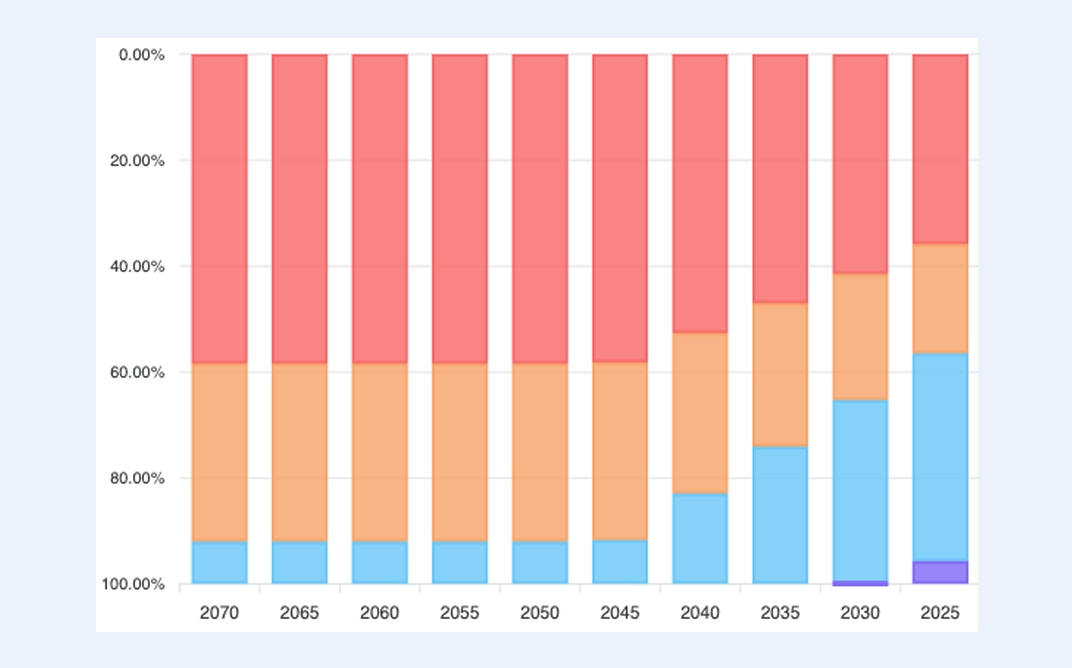

Planning for retirement means planning for the long term. Compound growth happens when the potential earnings in your retirement account grow on top of each other year over year.

Click for an example

Depending on your tax situation, you may be able to deduct the full amount you contribute to a Traditional IRA account from your taxable earnings. You may also qualify for the IRS Savers Credit for both Traditional and Roth IRA accounts, which offers a tax credit on up to $2,000 of your contributions to your retirement account.

Click for an example

If you move to another state or change employers you don’t have to transfer your account to another provider, you can contribute to your Crecer account in any state and with any employer.

Crecer’s system will automatically manage the mix of stocks and bonds in your retirement account to help keep your investments aligned with your personalized investment plan without incurring taxes.

Our system is designed to automatically manage your account without any action required on your part. You can relax knowing that your money is being invested with a strategy personalized for you.

After years of working hard, you may want more time for yourself. Saving for retirement today may provide you with more flexibility in the future.

Learn More